Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- Dec. 11, 2023

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

Biotech Dilemma: The Race for Research and Lab Space

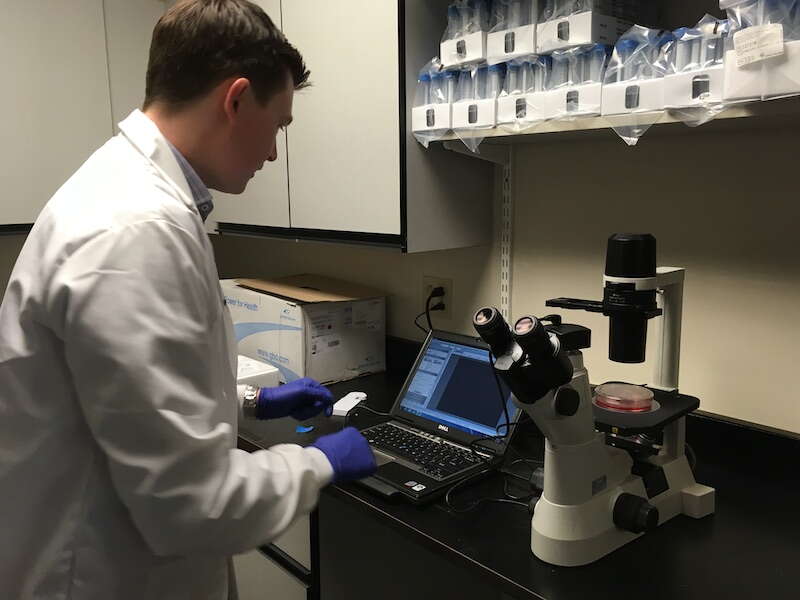

PHOTO | New Haven Biz

John Keogh, senior broker with Colliers International, in lab space at 5 Science Park on Winchester Avenue in New Haven.

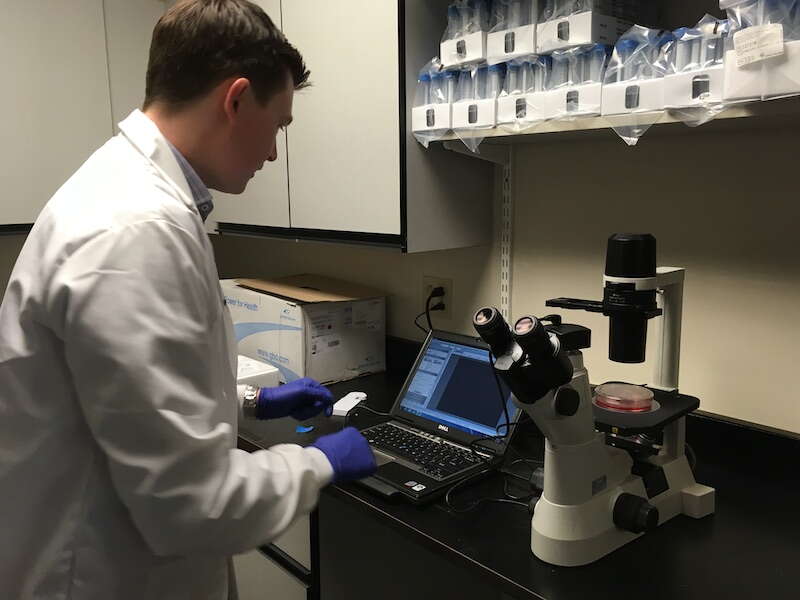

PHOTO | New Haven Biz

John Keogh, senior broker with Colliers International, in lab space at 5 Science Park on Winchester Avenue in New Haven.

The New Haven area has become a hub for thriving and growing young bioscience companies like Arvinas and Cybrexa Therapeutics, which are working to develop potentially game-changing cancer cures.

The region’s biotechs are developing treatments for a range of ailments, from Alzheimer’s disease to spinal-cord injuries.

But just as a growing infant can’t stay in an incubator for long, many New Haven-born bioscience companies need room to grow — and fast.

Adequate space, however, is hard to find.

Science Park on Winchester Avenue in New Haven is home to many of the region’s bioscience companies, including Arvinas, Cybrexa and Artificial Cell Technologies. According to John Keogh, a senior broker with Colliers International, who handles leasing for the property, it was “100-percent” leased as of mid-October.

“We have long-term tenants whose businesses are growing, and we can’t find space to accommodate their growth,” Keogh explains.

The same holds true for Science Park’s newer tenants, some of which are also navigating growth trajectories, according to Keogh: “We are having trouble meeting their needs.”

A spate of bioscience startups and the growth of existing ones has fueled a demand for more space. Some leaders fear that if these companies can’t flourish here, Connecticut risks losing them to other states, such as California, Massachusetts or North Carolina.

“If the powers that be want the biotech industry to continue growing [in Connecticut], it is imperative that someone create a way to create more lab space, both for startups and next-stage growth companies,” Keogh says. “We just don’t have enough lab space to accommodate the demand.”

“Someone with deep pockets needs to step up — either the state of Connecticut or Yale,” he adds.

Tim Shannon, MD, a general partner with the early-stage venture capital firm Canaan, began his career as a physician and now invests in companies, including Arvinas. He also chairs Arvinas’ board of directors, and has first-hand knowledge of the region’s lab space crunch. Previously, he was president and CEO of CuraGen Corp., a biopharmaceutical company focused on oncology.

“There is no lab space in New Haven for new companies or expanding companies,” Shannon says. “There is some is the surrounding towns — not much, and what does exist is very distributed, with a loose feel of being part of a biotech community.”

According to Shannon, while there have been discussions about new lab space coming online, he says it is likely between one and three years away from becoming a reality.

The dearth of suitable research facility space “is a problem if the area sees the biotech industry as any part of its future,” Shannon notes.

Scott Phillips, chief financial officer with Halda Therapeutics, a start-up drug-discovery company, searched for lab space when the company launched in early 2019. Halda ultimately settled on space in Branford.

“What I’ve been finding is that there is very limited lab space for start-ups,” Phillips said. “There is some in the suburbs, but no available space in New Haven for companies the size of Halda or the next step up.”

Photo courtesy Halda Therapeutics

According to Phillips, it isn’t an issue of pricing, but availability. While the company likes its Branford space, the preference is to be in close proximity to other biotechs in an urban setting “to build a sense of community,” he says.

“In Connecticut, there is very limited space to get at any price,” Phillips explains. “There needs to be a strong partnership between investors, risk takers, and possibly the state, to make it a priority to have space. The alternative is that companies will look to the suburbs, or quite frankly, out of state.”

One hurdle is the cost associated with building lab space in comparison with standard office space.

Bob Skolozdra, a partner with Svigals + Partners, an architectural firm in New Haven which specializes in laboratory planning and design, has worked with companies such as Alexion Pharmaceuticals and Arvinas on their laboratories.

Creating laboratory space is more expensive than traditional office space, according to Skolozdra. Laboratories require specialized infrastructure, since workers are dealing with chemicals and biological materials. These spaces have more safety and ventilation requirements and need back-up power, so these companies don’t “lose years of research” if the power goes out, Skolozdra notes.

Dawn Hocevar, president and CEO at BioCT, a New Haven-based not-for-profit organization that is working to grow the bioscience industry in Connecticut, said there is “absolutely a need” for more lab space in the New Haven area. This includes room for both startups and for companies beyond the newborn life stage that are growing and need larger spaces, she explains.

State officials are meeting with industry leaders to have conversations and solicit input, but according to Hocevar, there are no solutions yet.

While there had been a plan underway for BioCT to run and manage an incubator lab space at District New Haven under the Malloy administration, current Gov. Ned Lamont’s debt diet — aimed at improving the state’s yawning budget deficit — caused the plan to lose traction.

David Salinas, co-founder and CEO of District New Haven, says his group had been pursuing a collaboration with BioCT over the course of about a year that “had buy-in from several other parties.” The pursuit ended early this year, according to Salinas.

Salinas attributed this to “the new administration’s view on funding and focus.”

“We no longer intend on pursuing lab space,” Salinas says now. “Our goal with District is to solve entrepreneurial and community challenges through space and our unique value and offering, but it appears that this is one nut we couldn’t crack.”

District has heard from many companies, university faculty, individuals, the investor community, and international companies — all looking for various lab space options, according to Salinas.

“Local and state politicians need to do a better job of educating the general public on the importance of the life sciences within the state,” Salinas says. “I don’t believe we do a good job at explaining the economic impact — such as jobs and revenue — or the societal human impact this industry can have on our community and the world. We have some of the greatest minds, research and institutions in the world here in Connecticut. We all should be supporting our strong industry clusters.

According to Hocevar, although the District New Haven lab space project is dead, “there is potential in other areas in New Haven.”

As of mid-October, she wasn’t ready to give any specifics, adding, “Nothing is in stone yet.”

New Haven’s Interim Economic Development Administrator Michael Piscitelli says there are approximately 50 biotech companies in the greater New Haven area today, and addressing their need for more lab space is a “big issue.”

“It is a high priority for the city and state to figure this out,” Piscitelli explains.

According to Piscitelli, he is seeing interest from developers, though as of mid-October, he wasn’t ready to provide any details.

“We have some projects coming together and hope to see something announced in short order,” he says.

BioCT has opened Innovation Commons in Groton, which offers commercial-grade labs and other space. However, Hocevar said this facility is already at capacity with 30 companies housed there.

“That shows the demand that is out there,” Hocevar says. “It’s full even though it isn’t near a university.” Such as, for example, Yale.

Legislative focus

On the legislative front, Guilford State Sen. Christine Cohen (D-12), a co-chair of the legislature’s Bioscience Caucus and vice chair of the Commerce Committee, is acutely aware of the space issue.

“I am constantly hearing from startups about this need,” Cohen explains. “We have seen a surge of companies coming in — in New Haven, Branford and the state as a whole. Unfortunately, there is not a lot of space — not a lot of incubator space and not a lot of growth space. There is a tremendous need for infrastructure.”

In the meantime Bioscience Caucus members are listening to the bioscience community to understand its needs. The caucus will report back to committees with a goal of creating legislative proposals, explains Cohen. What are they hearing so far? Cohen says many companies mention the need for more space and improved transportation, like expanding Tweed New Haven Airport.

“The need for lab space is really pressing,” Cohen says. “It’s important to get these companies to not only start here, but be able to grow and thrive here.”

When asked if she is concerned about losing these bioscience businesses to other states because of the space crunch, Cohen says, “I am. We need to be mindful that these companies are looking to start and grow here.”

According to Cohen, competition from nearby states is at once a threat — and an opportunity. Some other biotech hubs, such as Cambridge, Mass. can be “overcrowded and costly,” she says, which has prompted some companies to look to Connecticut in search of more attractive alternatives.

“We need to help them by providing incubator space,” Cohen says. “It is an excellent time for bioscience in Connecticut, and they are creating life-saving technology and pharmaceuticals.”

The region’s affordability may be contributing to the space crunch, notes Keogh. With market rents for lab space in New Haven being low compared to other states, developers may be hesitant about the speculative building of additional lab space.

“If the [space] problem isn’t fixed, it makes the state less competitive in terms of an industry that can support the economy,” Keogh explains. “There are a lot of highly educated scientists in Connecticut, and it is a fertile ground for recruiting people to work in these companies. We are at a critical time in terms of needing to preserve the momentum.”

Related reading: From Nov. 8: Munson Street deal could ease area lab-space crunch

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments