Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 29, 2024

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

CT ranks among worst states for tax burden, study finds

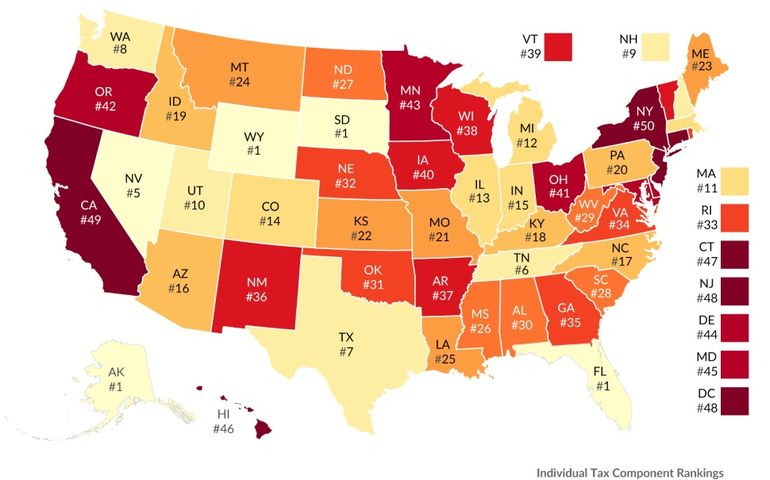

Connecticut ranked as the 47th worst state for individual income taxes, according to the Tax Foundation’s 2023 State of Business Tax Climate Index.

The Nutmeg State came in ahead of Washington, D.C. and New Jersey (tied at No. 48), California (49) and New York (50). Hawaii was ranked No. 46.

Connecticut dropped two spots in the rankings between 2020 and 2021, and has maintained its 47th-place standing since 2021.

The report by the Tax Foundation, a conservative-leaning nonpartisan think tank, takes into account factors such as deductions and business tax structures for sole proprietors in each state.

Alaska, Florida, South Dakota and Wyoming tied for first place in the rankings because they do not have an individual income tax or payroll tax other than the standard unemployment insurance deduction.

Nevada, New Hampshire, Tennessee, Texas and Washington were also among the top performers.

“The individual income tax is important to businesses because states tax sole proprietorships, partnerships, and, in most cases, limited liability companies and S corporations under the individual income tax code,” the Tax Foundation’s Janelle Fritts wrote in a summary of the report. “However, even traditional C corporations are indirectly impacted by the individual income tax, as this tax influences the location decisions of individuals, potentially impacting the state’s labor supply, and higher individual income taxes increase the price of labor.”

States that fared poorly in the Tax Foundation’s rankings tend to have high tax rates and progressive tax structures, Fritts said.

Connecticut’s graduated individual income tax rates range from 3% to 6.99%.

However, state lawmakers are currently debating several potential income tax cuts amid a projected budget surplus.

In addition, Connecticut has a 7.5% corporate income tax rate and a 6.35% sales tax rate. The total state and local tax burden in Connecticut is 12.8%, according to the report.

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments