Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- Dec. 11, 2023

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

Data center tax-break vote delayed despite governor’s endorsement

YouTube | digitalcarbonzulu

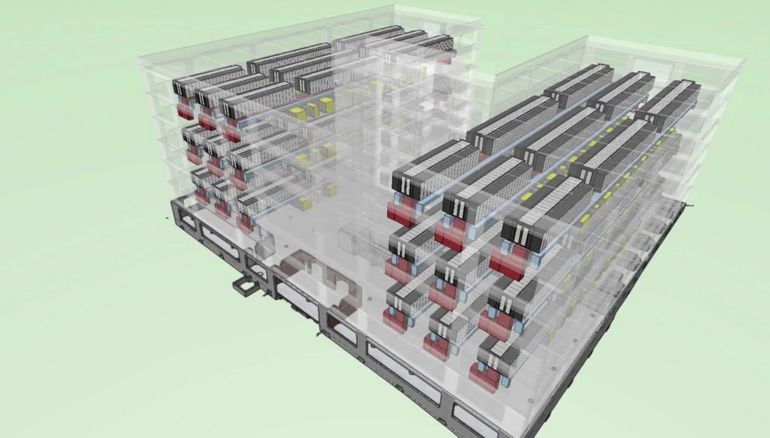

A rendered image of the first phase of the data center proposed by EIP in New Britain.

YouTube | digitalcarbonzulu

A rendered image of the first phase of the data center proposed by EIP in New Britain.

The State House approved a fast-tracked bill this week that would give tax breaks to data centers setting up shop in Connecticut.

House Bill 6514 would waive state sales taxes for 20 years on any company that invests at least $200 million on a data center in the state, or invests $50 million if the data center is located in a designated enterprise zone. The bill was approved 133-13 on Wednesday.

Some lawmakers questioned the energy usage and environmental impact of data centers, in addition to the fast-tracked process the bill went through before adoption. To address those questions, a planned Senate vote on the bill was delayed until to Monday,

“Connecticut needs to get in the game and bring this industry to our state,” Gov. Ned Lamont said in a statement of support for the bill. “This is a once-in-a-generation opportunity to show the technology industry that Connecticut supports this sector and we welcome their development in our state.”

With 11 data centers currently located in Connecticut, technology boosters are seeking incentives to lure more companies into locating here and creating highly paid IT jobs.

“We need to approach emerging technologies like these data centers with the utmost focus, as they represent changing trends and stronger economic results,” State Sen. Steve Cassano (D-Manchester) in support for the bill. “A warmer reception to these locations in our state could lead to many strong years of business growth and resulting economic strength.”

A data center, defined as a facility built to house a group of networked computer servers, would also be exempt from any financial transactions tax or fee that may be imposed by the state through trades of stocks, bonds, or any other financial products for 30 years from the date a new facility is completed.

CT Mirror reporting was used in this report.

This bill could give an outsourcer such as Infosys an unfair advantage in Connecticut IT Market. Waiving taxes for 20 years would give any outsourcer that were to spin up a Data Center an unfair operational cost advantage over any existing Data Centers already in the state. This could allow any outsourcer to submit unsolicited bids to any of the existing eleven company providing internal IT Processing Services. It would be highly probable this bids could now significantly undercut those of the existing providers. If this were to happen, it could leave the state with one or two "no tax" outsourcing Data Centers, as opposed to the eleven taxable centers we currently already have. That would cause a significant loss in tax revenue and jobs provided by existing Data Centers if they were to be successfully outsourced. Additionally, outsourcers are notorious for running their facilities "just beyond adequate", and with staff that is many times brought in under H-1B Visas. Legislators must be very cautious in how the handle this exposure.

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

1 Comments