Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- Dec. 11, 2023

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

Economic Engine: Harbor project primes New Haven’s port for future growth

PHOTO | TIM GREENWAY

Connecticut Port Authority Executive Director John Henshaw sees growth ahead for the Port of New Haven.

PHOTO | TIM GREENWAY

Connecticut Port Authority Executive Director John Henshaw sees growth ahead for the Port of New Haven.

Sitting in traffic at the Tomlinson Bridge just outside the Port of New Haven, it’s hard to appreciate the importance of the ships passing below.

But that barge maneuvering ever-so-slowly under the span and chugging its way toward New Haven Harbor represents one facet of a state maritime industry with $11.2 billion in annual economic impact that employs nearly 60,000 people across Connecticut.

That barge is also an avatar of New Haven’s busy port — a waterfront economic engine that got busier last year due to the national supply chain crisis.

The number of ships visiting the port jumped by 35% in 2021 compared to 2020, and cargo tonnage for last year is expected to exceed pre-pandemic levels, according to port officials.

“It’s tied to the things you’ve been reading about, the supply-chain issues worldwide,” said Sally Kruse, executive director of the New Haven Port Authority. With container ships idling off major shipping hubs, “people are looking at using other ports.”

Drive the rutted streets within the New Haven port and you’ll see towering piles of lumber packaged in plastic from companies like Pfeifer, a European wood processor. Semi trucks by the dozen sit empty and parked in the swales awaiting loads as fuel tankers rumble past to get to the interstates.

Wood products and concrete raw materials started flooding in and out of the Elm City, “when things started to pick up with the economy and the construction industry,” Kruse said. “Those demands are being served by the port.”

Cargo like steel, gas and oil has been arriving at a steady pace as exports like scrap metal begin to recover to pre-pandemic levels.

The success and potential of New Haven’s port was endorsed recently by the U.S. Army Corps of Engineers, an agency known for hedging its bets on major infrastructure projects.

With the help of the state’s Washington delegation, the Corps earlier this year greenlighted a $63 million effort to dig out and deepen the federal navigation channel within New Haven Harbor, along with the ship maneuvering area and turning basin.

The channel, now filled with silt to a level a bit shallower than its 35-foot authorized depth, will be dredged then deepened to 40 feet over the next few years. That will allow for larger ships to visit the port directly and fewer delays due to shallow waters at low tide.

Fill from the excavation will be repurposed to create salt marsh, reefs and shellfish habitat.

When completed, the New Haven Harbor Navigation Improvement Project is expected to generate $99 million in additional sales, about 1,000 new jobs and $51 million more in wages and benefits for the state and region, according to the Corps’ economic analysis.

“There is anticipated growth in both bulk and liquid cargo coming into the port,” said John Henshaw, executive director of the Connecticut Port Authority.

New Haven’s port, the second-busiest in New England, has advantages that have helped push forward projects like the deepening, he added.

“It has a history, it has a track record. It has proximity to the places where the cargo is going,” Henshaw said.

New Haven port takes the lead

Among the state’s three deep-water ports, New Haven alone is poised for commercial growth in the near term, Henshaw said. Bridgeport’s cargo volume has declined over decades as its harbor gets shallower due to silt, to the point that the federal government is reluctant to invest in dredging or deepening its channel.

New London's State Pier, currently closed for an overhaul, has been designated mainly for use by the offshore wind industry in coming years, but may become a future player for other cargoes.

In the short run, New London’s revamp has been beset by delays and cost overruns. Initially set to cost $93 million and open this month, the project is estimated to take at least another year and cost $235.5 million or more. The key role in the State Pier project played by Konstantinos Diamantis, the ex-state official fired by Gov. Ned Lamont last year over alleged misconduct, has added to controversy.

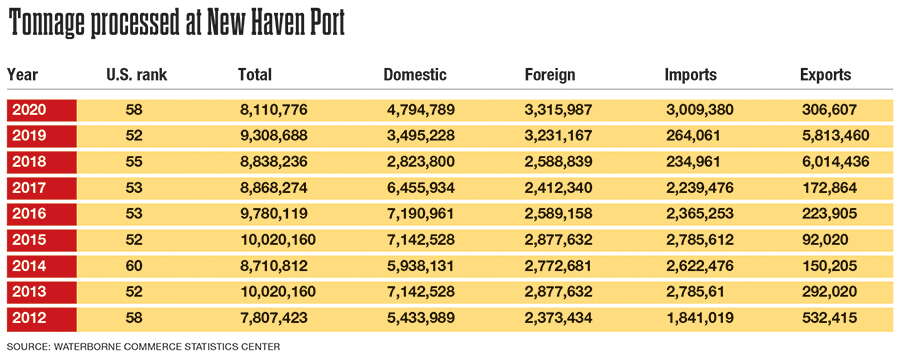

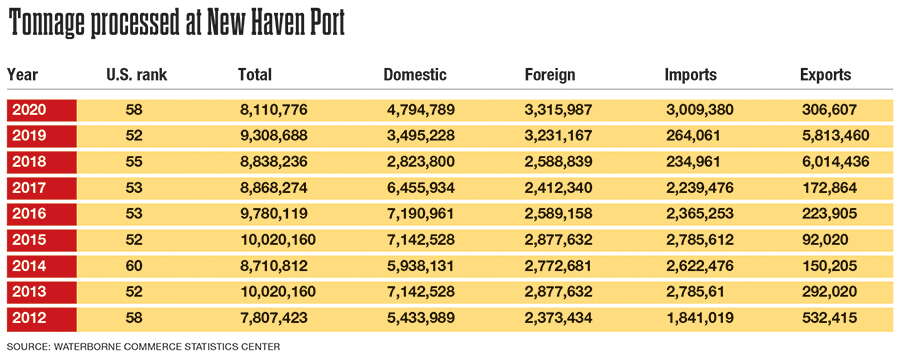

New Haven ranks at around No. 50 nationwide in terms of port tonnage, with 9.3 million tons of cargo handled in 2019, not far behind Boston, with 16 million tons, and far ahead of Bridgeport, with 1.8 million tons. (All Northeast ports are dwarfed by Gulf petro/container behemoths like Houston, with 285 million tons in 2019.)

Most ports nationwide saw a drop-off in cargo in 2020 due to the onset of the COVID-19 pandemic but New Haven expects to more than recover when 2021 data is released by federal agencies later this year.

As of now, New Haven lacks the space and special equipment like gantry cranes needed to handle container and cruise ships.

Port fuels region’s petroleum needs

New Haven’s port, a 366-acre district bordered by harborfront and the Quinnipiac River, is mostly privately-owned land and dominated by seven commercial operators with facilities called terminals. The largest, Gateway Terminal, specializes in bulk cargo like asphalt, petroleum, cement, steel and salt and has drawn the most business in recent years. Its operations are centered at 400 Waterfront St.

Petroleum products dominate at the Getty, Gulf and Magellan terminals, with their barbed-wire-encircled tank and storage complexes lining Forbes Avenue and Waterfront Street. About 70% of the state's home heating oil, gasoline, diesel, jet fuel, ethanol and biodiesel passes through the New Haven port, along with much of the fuel supply for western Massachusetts.

Manufacturing also happens at the port at the American Green Fuels facility at 30 Waterfront St., the largest biodiesel production plant in New England. Production has grown steadily at the plant in recent years and the company recently secured approval from the city for a 1,400-square-foot addition.

As a group, the terminals operate 12 berths with more than 6,000 feet of quays, or platforms projecting into the water for unloading or loading barges and ships.

New Haven Port owners and operators have been active in advocating for the district, drawing new customers and advancing port improvements, Henshaw said.

“They’ve been successful in generating business, and Gateway in particular is seeing a large increase in vessel calls,” Henshaw said.

But demand for port space has increased to the point that Henshaw himself is getting regular calls from companies seeking space at the port.

Their first question: “How deep is the channel,” he said.

Real estate plays

Another sign of the port’s success is the excitement around a recent property sale.

New York-based Criterion Group announced in February it would pay $21.4 million for a 133,650-square-foot industrial complex at 100-102 Wheeler St., in the port district.

The deal sale set a cap rate record for all industrial properties sold in the New Haven metropolitan area, according to the broker, Matthews Real Estate Investment Services.

Two decades ago, the Wheeler Street complex was a key element in a “feeder barge” proposal that would have opened the port to cargo from New York-bound container ships. When New Haven lost out to Bridgeport on the project in 2003, it was subdivided for other uses. Now port officials see the property as potential space allowing for more growth. (Bridgeport was unable to execute the feeder barge plan.)

The property’s new owners haven’t commented directly on their plans, but the brokers said they paid the record price due to “the storage capabilities and redevelopment opportunities of the investment.”

“With the correct investments in the property, it can make the port a more competitive location for ships to dock and transport cargo, bringing more revenue to the city,” said Matthews Senior Associate Kyler Bean.

Another deal that recently closed was the sale of the New Haven Harbor Station power plant, which borders the port district to the south and has excess land that could be used for storage or other port-related activities.

ArcLight Energy Partners announced last August it would buy the former United Illuminating facility as part of a $1.92 billion deal to acquire New Jersey-based Public Service Enterprise Group’s energy portfolio.

The potential to acquire land from the power station could help build the port’s infrastructure and set the stage for further expansion, said Kruse of the port authority. Recent improvements have also been made to the port’s rail infrastructure to connect terminals to major lines and reduce truck traffic.

Another growth prospect for the port could be its Foreign Trade Zone, a designated area with special tax benefits. Bustling decades ago with business from import/export manufacturers like Saab and gun-maker O.F. Mossberg, the port’s zone lay quiet for years until Gateway expanded it in 2019 to 57 acres within the district.

A new effort with the Greater New Haven Chamber of Commerce is seeking to draw more business to the zone.

The harbor project and infrastructure improvements are crucial for continued growth at the port, said Judith Sheiffele, who helmed the New Haven Port Authority from its creation in 2003 until this January.

“[The channel deepening] will actually increase the efficiency and actually make New Haven more competitive,” Sheiffele said.

“To have this project fully funded now is a very significant development,” agreed Henshaw at the state port authority.

With cargo ships getting bigger and bigger worldwide, New Haven needs to go deeper to both keep up and thrive into the future, he added.

“It’s hugely important,” Henshaw said.

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments