Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- Dec. 11, 2023

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

Flush with cash: Record venture capital funding driving local startups’ demand for CFO talent

PHOTO | FILE

Per Hellsund is the CEO of New Haven-based Cybrexa Therapeutics, which recently hired a new chief financial officer.

PHOTO | FILE

Per Hellsund is the CEO of New Haven-based Cybrexa Therapeutics, which recently hired a new chief financial officer.

For much of the U.S. economy, 2020 was a year best forgotten.

Federal Reserve Bank numbers show more than 100,000 small businesses permanently closed, with many others under duress heading into 2021.

But for venture capital, 2020 was a banner year. According to figures from Pitchbook and the National Venture Capital Association (NCVA), investors poured more than $156.2 billion — or $428 million per day — into U.S.-based startups last year, an 11 percent increase from 2019.

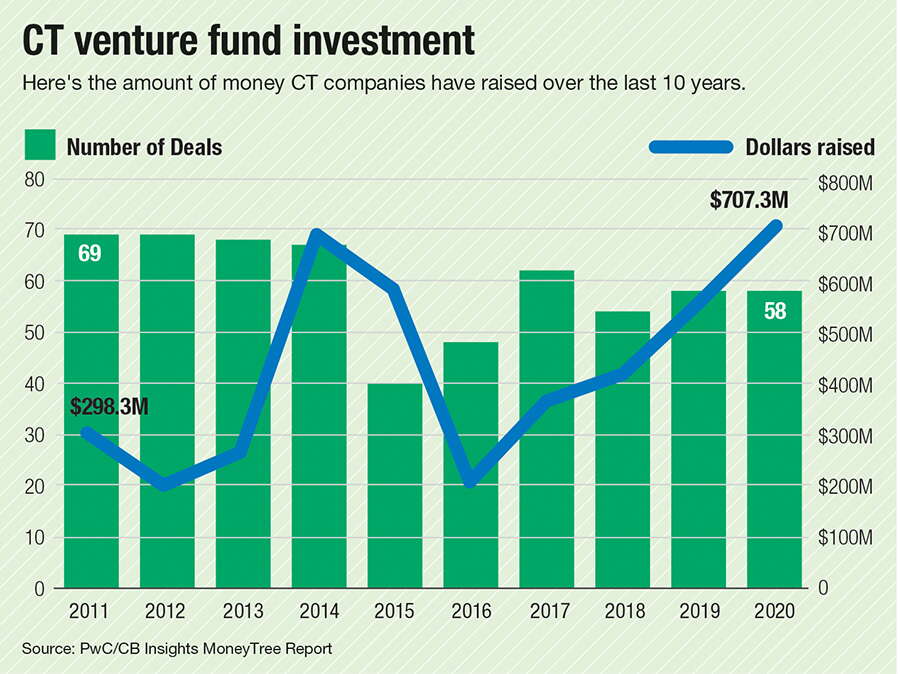

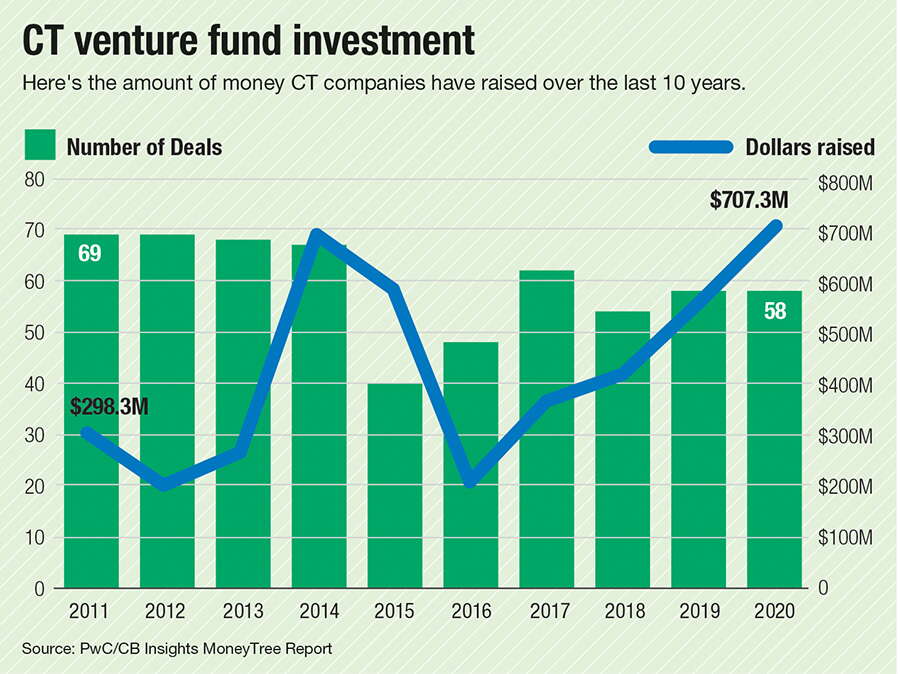

In Connecticut, startups — predominantly technology or life sciences ventures located in Greater New Haven — hauled in more than $707 million in funding in 2020, a 27 percent increase year-over-year, and the most money raised in a single year in the past two decades, according to numbers from a PwC/CBInsights MoneyTree Report.

Connecticut Innovations (CI), the state’s quasi-venture capital arm, invested more than $43 million in nearly 100 startups in the state in fiscal year 2020 alone, a 10 percent increase from the prior year.

And it’s not just a short-term phenomenon. Over the past decade, the median venture capital investment across all phases of startups has increased steadily.

The complexity and size of today’s venture deals have created a growing demand for startup companies to hire a chief financial officer earlier in their life cycle, experts say. In fact, from May 2020 to May 2021, the number of CFOs hired by startups with assets between $10 million to $100 million — a range typical of early or mid-stage companies — has increased by 95 percent, according to S&P Global Market Intelligence data.

Connecticut Innovations CEO Matt McCooe said he is encouraged by the CFO trends emerging among early-stage companies.

In the late 90s, he says, it was common for a startup’s founding team to include a CFO, but many companies over the past decade-and-a-half moved away from that approach to conserve investments and outsource functions like finance.

But as the amount of venture capital and investor expectations increase, and short- and long-term growth strategies develop, CFOs can play a critical role beyond simply balancing the books, he said.

Over the past three years, close to half (43 percent) of first-time CI-funded startups had a CFO in place, McCooe said.

“A [startup] CEO can’t do everything,” McCooe said. “A strong [CFO] can keep an eye on expenses, help craft a vision of the organization, drive product and help raise more capital.”

Shaping strategy

Hiring a CFO is a decision more early-stage startups are making. Last month, New Haven-based Cybrexa Therapeutics, an oncology-focused biotechnology company, founded in 2017 and spun out of Yale’s research-to-startup ecosystem, hired Stephen Basso as its new CFO as the company’s lead therapeutic heads toward its first round of clinical trials.

Per Hellsund, Cybrexa’s CEO, says the company has raised more than $47 million to date but as it gears up for an IPO in 2021 or 2022 — to attract investment for additional trials — hiring a CFO was necessary.

Basso, who previously served finance leadership roles at other pharmaceutical companies including Alexion and Pfizer, says the CFO role has evolved from shepherding the finances to being a strategic business partner.

“One of the things about joining Cybrexa is to partner not just on the finance side, but also helping to shape and frame the clinical strategy in terms of setting the path forward for the organization,” Basso said.

Having that type of business partner earlier in the company’s life cycle has become more important, says John Pacifico, the chief operating officer and CFO of the East Coast for Westport-based venture investor Canaan.

“There’s an appetite from larger strategic companies to get involved earlier in the development cycles and that has created an opportunity for startup companies — particularly in technology, to go public earlier in the life cycle than we would have seen 10 years ago,” Pacifico said.

He noted the re-emergence of special-purpose acquisition companies, or SPACs — which require fewer regulatory hurdles than traditional IPOs and can be a pathway to startups going public via acquisition by a larger company — has accelerated the types of people, including CFO-caliber talent, at the leadership helm for developing companies.

Another driver of the CFO trend, Pacifico says, is the volume of money being funneled into startups.

“[These companies] are raising more money faster than they ever have and there’s planning that needs to be done to really make that work,” he said. “Startups need to be identifying who might be interested in funding the next round of financing, [understanding] the criteria [investors] would require to be interested and working networks to build relationships with prospective investors.”

More money, more responsibility

Frank Milone, who runs the emerging companies and venture capital audit practice for Glastonbury-based accounting and consulting firm FML, says investors’ expectations about progress at certain funding rounds has also accelerated and driven the trends toward CFOs.

Because startups, he says, have more access to early-seed money and larger Series A investment, the expectation from some investors is that scaling the company may be possible in the first funding round.

Growth and scale can create several challenges that a CFO is best equipped to solve, he said.

“If an [early-stage] company needs to pivot to support accelerated growth or change because growth stalls, how do they reallocate funding or conserve cash flow to get further down the development path,” Milone said. “Investors want to know a company has the right individual to address those [situations].”

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments