Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 29, 2024

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

How Grim is Connecticut's 2018 Economic Outlook?

Source: University of New Haven

Source: University of New Haven

Photo | Contributed

A.E. Rodriguez

Photo | Contributed

A.E. Rodriguez

Photo | Contributed

Brian T. Kench

Photo | Contributed

Brian T. Kench

Source: University of New Haven

Source: University of New Haven

Source: University of New Haven

Source: University of New Haven

General Electric’s departure from Connecticut was a punch to the gut. Aetna’s departure was a blow to the head. Alexion’s departure adds insult to injury. The budget is a mess; people are heading for the exits. So, the open question remains: how grim is Connecticut’s 2018 economic outlook?

The University of New Haven’s Economic Performance Laboratory, an economics department collaboration among its students and faculty, produces three metrics to help us answer the question.

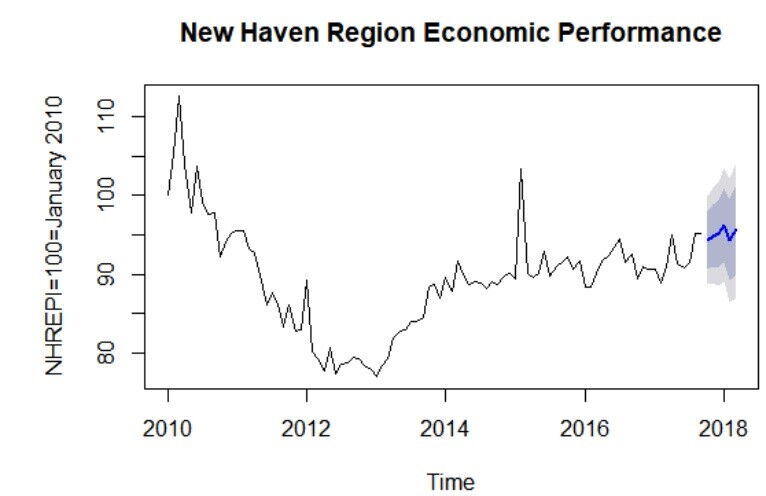

Economic Performance Index

The Economic Performance Index measures the performance of New Haven County and the surrounding region. The Index has five components: education and health services for all employees, building permits, average weekly hours worked, average weekly earnings, and the unemployment rate.

The Index was 95.2 as of September 2017. This is a decrease of .02% from the previous month and an increase of 2.8% from the previous year. The Index is forecasted to range from 94.35 to 96.31 through March 2018, which suggests a continued slide sideways for the New Haven region.

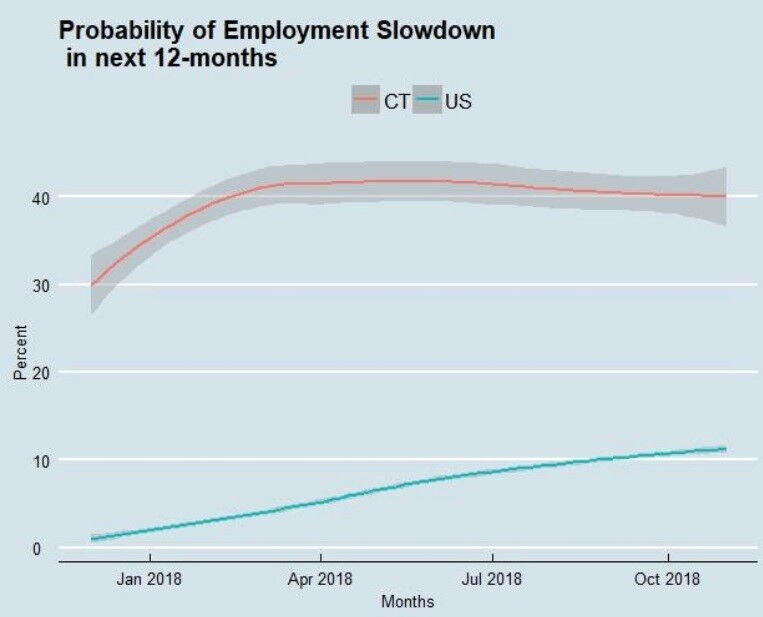

Probability of a Connecticut Employment Slowdown

Connecticut faces a multi-pronged whammy: federal tax law changes and continued state deficits. First, although it’s not fully clear yet, federal tax law changes will likely cap state and local tax deductions for individuals at $10,000 and limit further the home mortgage deduction. Second, despite having adopted a new budget a month or so ago, the state is again running a deficit because sales and tax revenues are down over $200 million halfway into the budget year.

We conducted an assessment based on historical employment performance. This appraises the likelihood of a Connecticut employment downturn in the near future. Our model tells us that over the next year we have around a 40 percent chance of hitting a slowdown. By contrast, a likelihood of national recession, using the same methodology, is close to 11 percent towards the end of 2018.

How likely are we to slow down while the U.S. breaks all kinds of records? The chances are high. Connecticut’s downturns and recessions are not always synchronized with those of the nation. In fact, over the last 27 years we have not been synchronized with the nation approximately 11% of the time (38 of 334 months). We were down for 25 months when the national economy was humming along happily and we have done better than the national economy 13 months when the US economy was sputtering.

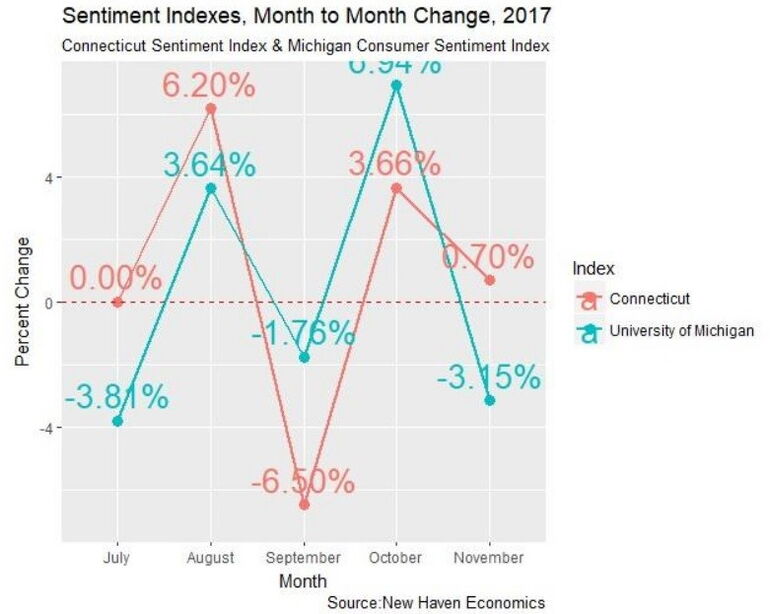

Connecticut Sentiment Index

The Connecticut Sentiment Index is based on a count of positive and negative words appearing in the online editions of Connecticut newspapers on the 15th day of every month. The index is the ratio of positive to the sum of positive and negative words, multiplied by 100.

Sentiment in Connecticut turned-upwards in November by nearly 1%, while the sentiment in the US went down by over 3% as documented by the Michigan Sentiment Index. The resolution of budget impasse and elections in Connecticut might be the reason for our tiny blip up.

The performance forecasts and the slowdown-likelihood forecast provide us with a general sense of where the economy is headed. As with all forecasts, however, they are uncertain. Nonetheless, together the two forecasts constitute a good baseline capable of informing our planning and decision making.

The Sentiment Index – based on a more recent “reading” of the sense of the state, allows us to update the baseline information and construe a better-informed sense of the economic outlook. These three indices are not intended to provide “the” answer. Rather, they constitute the pieces of a decision-making process based on updating the forecast-derived insights with applicable public information – which does not exclude your own, private, subjective information.

Yes, on balance, the near-term outlook for Connecticut is grim. Why are we in this situation? It’s a perfect storm. At the federal level, the ever-changing landscape of taxes and uncertainty over future unfunded liabilities are generating additional disincentives for companies to invest in capital and long-term employment relationships. Within Connecticut, there have been a number of labor-related, tax-related, and spending-related policy mistakes that in our view have contributed significantly to the situation. An overly generous but currently unsustainable social safety net, inflexible and generous labor contracts, and a non-competitive political landscape have all contributed to policy decisions that enhance inefficient institutional persistence and business and entrepreneurial uncertainty.

But, if we choose to do so, we can help make Connecticut competitive again. Buckminster Fuller once said, “Reform the environment, stop trying to reform the people. They will reform themselves if the environment is right.” We couldn’t agree more.

A.E. Rodriguez is professor and chairman of the department of economics at the University of New Haven.

Brian T. Kench is professor of economics and dean of the college of business at the University of New Haven.

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments