Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 29, 2024

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

Industry Catalyst: Elm Street Ventures helps power New Haven biotech boom

PHOTO | Gary Lewis

Elm Street Ventures Managing Partner Chris McLeod (left) and founder and Managing Partner Rob Bettigole invest to bring fledgling companies to the next level.

PHOTO | Gary Lewis

Elm Street Ventures Managing Partner Chris McLeod (left) and founder and Managing Partner Rob Bettigole invest to bring fledgling companies to the next level.

Above the conference table at Elm Street Ventures hang a series of images of scientists at work — the literal “poster children” for this venture-capital firm’s success.

At center is Arvinas, the growing biotech firm with a market capitalization of $3.3 billion that promises to double its New Haven workforce in the next five years. At left is P2 Science, the Woodbridge green chemistry company that is drawing interest from beauty giants worldwide and operates a manufacturing site in Naugatuck.

But the wall at Elm Street’s office would have to be much longer to take in the accomplishments of the firm, which has been instrumental in bringing hundreds of jobs and hundreds of millions in investments to New Haven.

“There are a lot of much larger venture companies out there, but there are few that are boutique, more retail, willing to spend the time in building those deep relationships with the local community,” said Arvinas founder Craig Crews. “I view Elm Street playing a very critical role in the local biotech ecosystem.”

Crews’ own path to starting Arvinas highlights Elm Street’s role as a catalyst for biotech growth. A research scientist and professor at Yale, Crews had started a company in California in 2003 based on his pioneering work in harnessing the body’s own protein disposal system to fight disease. The company was a success, but Crews was looking for new challenges.

A few years later, Crews met Rob Bettigole, Elm Street’s founder and managing partner. The two would meet occasionally at Caseus restaurant and discuss turning his work into additional enterprises.

“He was very encouraging of starting something here,” Crews said. “He really was a major driver in getting me thinking about doing something here in New Haven.”

Elm Street Ventures (ESV) co-led Arvinas's first Series A funding round in 2013 with Canaan Partners, 5AMVentures and Connecticut Innovations, raising $15 million for the fledgling company. Arvinas is now the firm’s biggest success story and a beacon to other scientist-entrepreneurs looking to start companies.

“It’s the earliest stage ventures that have always appealed to me the most,” said Bettigole, who launched ESV in 2006 with an initial $25 million fund.

Getting results

After a career at major venture funds in New York and time spent growing and selling his own startup, Bettigole said he was inspired to work in New Haven after learning of Yale’s mixed record on entrepreneurship at the time.

While raising capital for the first ESV fund, Bettigole highlighted the fact that Yale affiliates were launching only four companies a year at the time, compared to 17 a year for MIT affiliates. Executives at the Yale Investments Office, who manage the university’s $31 billion endowment, wanted to change that and have been the largest investors in ESV.

“There are a few different reasons why we're excited about the partnership with Elm Street,” said Matt Mendelsohn, a director at the Yale Investments Office. “Number one is confidence in their ability to generate really interesting results that make a difference in the bottom line of the university.”

Economic development in New Haven is the second reason, and third is “opportunities coming out of the Yale ecosystem for professors and researchers.”

“All of that has contributed to a really interesting, dynamic environment where if you’re a professor or researcher you have a lot of resources to help you build,” Mendelsohn said. “Those companies then stay in the area and then generate a really nice feedback loop. That talent often becomes the next generation of entrepreneurs who start that cycle over again. We’re really excited about all that progress.”

Yale’s stake in the fund has helped bridge the gap between early-stage startups and later investments by bigger firms. ESV’s initial investments in new companies range from $500,000 to $1 million. If a company does well, ESV may kick in an additional $2 million to $2.5 million over multiple rounds. When startups grow to the Arvinas level, ESV steps aside for the VC giants to flood them with hundreds of millions in cash.

Elm Street has two full-time employees and four part-time venture partners and recently closed its second fund, topping out at $32.5 million. They have already made eight investments.

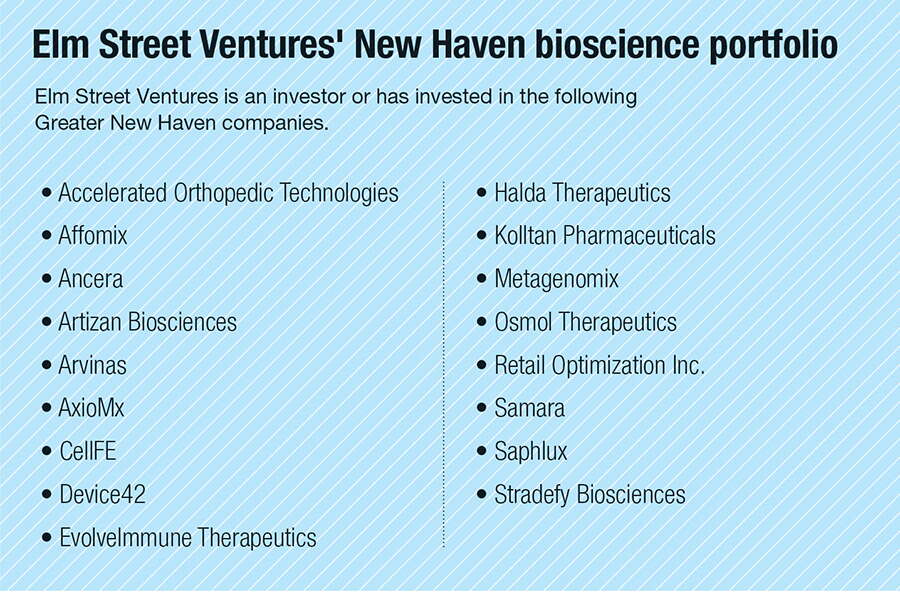

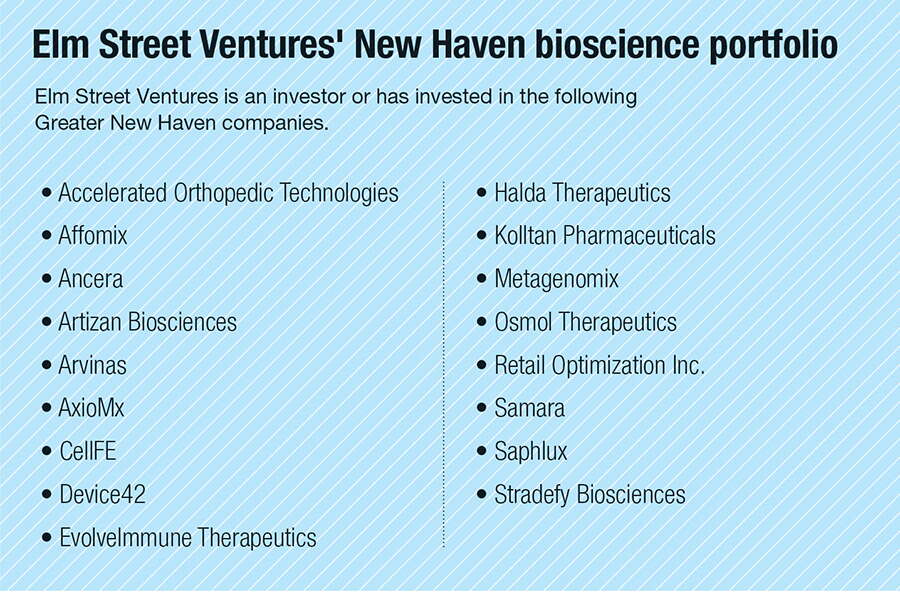

Since its founding, ESV has invested in 28 companies and has $57 million in funds under management.

“There really needed to be a catalyst, ... to be a professionally-managed fund that was focused here,” Bettigole said. Now, he celebrates a newer player that can step in at an even earlier stage: the Blavatnik Fund for Innovation at Yale that offers fledgling entrepreneurs grants up to $400,000 to do research that may translate into a company.

“The availability of that money has been tremendous,” Bettigole said. “Science takes time. Some things are early but there’s more and more of them.”

Seeding the growth of an ecosystem

“They’ve definitely been a huge part of why we are where we are,” Usha Pillai, a biotechnology strategist for the Economic Development Corporation of New Haven, said of ESV. “Having them locally helps build stronger ties, it builds that network, which is so important for us.”

The momentum created by recent biotech success stories can help overcome the challenges facing the industry now: a shortage of lab space in New Haven and the city’s relatively low profile compared to other tech centers like Cambridge, Pillai said.

“We need to toot our own horn,” Pillai said. “We know what we have locally but we need to get the word spread beyond our walls — locally, nationally and internationally — to talk about the tremendous growth we have experienced in the past decade or so. We need to shine a light on our biotech hub.”

Elm Street’s role in helping structure companies at an early stage has been crucial in building the biotech hub, said Jeffrey C. Solomon, partner-in-charge of assurance services for the New England Region of Marcum, a national accounting and advisory firm with an office in New Haven. Solomon worked with New Haven biopharma superstar Alexion (now owned by AstraZeneca) in its early stages and focuses on the industry.

“The mentorship that they’re giving a lot of the startups has really been invaluable,” Solomon said. “You really need that understanding of how these companies work.”

Elm Street’s role in hiring C-suite executives and contracting professional services can make the difference between success and failure at companies started by scientists, most of whom have little experience in the business world, Solomon added.

“What we’ve seen is there are some unbelievable minds with some unbelievable ideas, but to understand a business model and what to do next with that is another story,” Solomon said.

Elm Street’s ties to Yale give it unique access and the ability to shape young companies, he added.

“They bring more than just a checkbook to a deal,” agreed J. Dormer Stephen, co-chair of the business and finance practice group at law firm Shipman & Goodwin LLP. “They roll up their sleeves and they really help on the company-building side, where they’re helping with strategic planning and bringing the right people into the company.”

Stephen has worked with Elm Street and startup clients for 25 years in New Haven and has never seen the scene as vibrant as it is now.

“It’s an exciting time to be part of the biotech ecosystem in Connecticut and especially in greater New Haven,” Stephen said. “It's encouraging to see not only the quantity of the companies that are being created and funded but also the quality. The amount of capital that these companies are raising and the valuations at which they’re raising them are really remarkable.”

New Haven’s biotech scene has reached the point that talented people are more willing to move to the city, confident they have job prospects beyond the few major players, Stephen said.

“There’s now a stickiness to the human capital,” he said.

“When you recruit specialized talent, it’s a risk,” said Chris McLeod, managing partner at Elm Street Ventures. “They feel less concerned if there are other opportunities right in the area.”

McLeod joined Elm Street after a career in startups including a top role at CuraGen, the genomics pioneer founded by serial entrepreneur Jonathan Rothberg. He sees New Haven as close to breaking through to the next level with its biopharma industry.

“The one thing that we really need is to get that critical momentum or crucial mass and I think we’re right on the verge of that,” McLeod said.

Future beyond biopharma

Elm Street Ventures and other startup capital providers like Connecticut Innovations are increasingly looking beyond biopharma for future local innovators.

One frontier is “green chemistry,” the eco-conscious field pioneered by Yale scientist Paul Anastas. Green chemistry innovator Neil Burns was giving a talk at a conference in 2011 when Elm Street Venture’s Bettigole approached him about coming up to New Haven to meet Anastas. ESV went on to capitalize their collaboration.

Now Burns is CEO of P2 Science, a breakthrough green chemistry firm with sites in Woodbridge and Naugatuck. Burns said he was drawn by not only the talent in New Haven, but the infrastructure that supports emerging companies. For example, P2 Science often uses the technology at the Yale Instrument Center, which provides chemical analysis services at a reasonable cost.

But Elm Street Ventures provided the critical spark that ignited P2 Science, Burns said.

“Rob [Bettigole] was there at the beginning and has been a good supporter and mentor of the company as a whole,” Burns said. “That’s really the key role of an investor that comes in at an early stage, to add value through advice and contacts and networks as well as the money. Rob and Elm Street Ventures have been critical in that regard.”

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments