Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- May 13, 2024

- April 29, 2024

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- + More

Special Editions

- Lists

- Viewpoints

- HBJ Events

- Business Calendar

- Custom Content

NYC digital currency investor moving to Stamford, expected to create over 300 jobs

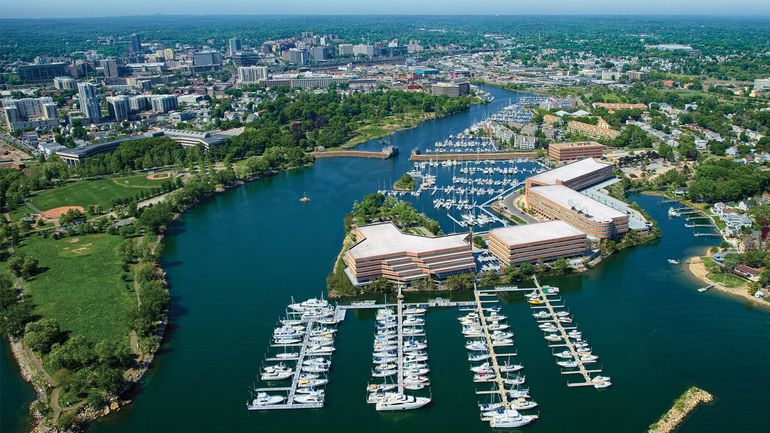

Photo | Shippan Landing

Photo | Shippan Landing

Digital Currency Group, an investor in bitcoin and blockchain technology companies, is moving its headquarters from New York City to Stamford, Gov. Ned Lamont announced Monday morning.

DCG, which has invested in over 200 blockchain companies and owns several subsidiary businesses, signed a lease for over 90,000 square feet in the Shippan Landing complex at 290 Harbor Drive in Stamford. The firm is overseeing renovations at the site and expects to open its doors there in late 2022, together with subsidiaries Grayscale Investments, a digital currency asset manager; trading platform TradeBlock; DCG Real Estate; and wealth management business HQ, which will all be housed in the same space.

The company is set to receive a grant in arrears of up to $5 million to support the move from the state Department of Economic and Community Development, contingent upon its creation and retention of more than 300 new, full-time jobs, state officials said.

“Attracting new investment and job creation opportunities to Connecticut is a top priority for our administration and today’s announcement is another indication that we are seeing results,” Lamont said in a statement. “Digital Currency Group’s decision to relocate their headquarters here is the latest example of how Connecticut is the ideal location for leading-edge companies that are focused on business growth.”

CEO Barry Silbert, who formed DCG in 2015, said Stamford and the state offer a combination of attractive features that ultimately helped Connecticut’s fastest-growing city pull ahead of other potential locations in New York and New Jersey during DCG’s relocation discussions.

“It quickly became clear that Connecticut had everything we were looking for in a new headquarters,” Silbert said. “Its proximity to major metropolitan areas combined with its infrastructure, talent, business-friendly environment and world-class facilities to house our rapidly-growing organization made it an easy choice. We are committed to making our new home in Stamford a hub for the next generation of fintech and blockchain entrepreneurs.”

Connecticut has had some success in recent years convincing finance and financial technology companies to depart the immediate New York City area for cities in Fairfield County, but DCG represents by far the state’s boldest foray into the bitcoin and blockchain industries, which have emerged as the most dynamic and scrutinized fields in the financial sector.

Grayscale is the world’s largest digital currency asset manager, with more than $50 billion in assets under management.

“Cryptocurrencies like bitcoin are the new frontier for financial investing, and DCG is at the forefront of this burgeoning sector,” said DECD Commissioner David Lehman and Peter Denious, president and CEO of business recruitment organization AdvanceCT. “Connecticut is a great fit for dynamic investment firms like DCG that are disrupting the marketplace and showing great growth potential over the long-term.”

In addition to the businesses that are relocating to Connecticut, DCG also owns and operates CoinDesk, a media, research and events platform; Genesis, an institutional lending and brokerage firm; Foundry, a financing and advisory company focused on digital asset mining and staking; and Luno, a global digital asset exchange and wallet.

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments