Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 29, 2024

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- + More

Special Editions

- Lists

- Viewpoints

- HBJ Events

- Business Calendar

- Custom Content

Bill to allow chambers, trade groups to pool members for health benefits gains support

ERICA E. PHILLIPS / CT MIRROR

The Connecticut state Capitol.

ERICA E. PHILLIPS / CT MIRROR

The Connecticut state Capitol.

Legislation that would allow trade associations and chambers of commerce to pool their members and offer them self-funded health benefits received broad private-sector support last week.

Representatives of about 50 organizations — including chambers of commerce, trade groups, nonprofit organizations, and private businesses — presented testimony on Feb. 27 to the state legislature’s Insurance and Real Estate Committee in support of House Bill 5247.

The legislation would allow qualifying chambers of commerce and trade associations to act as one large employer and offer their members self-funded health insurance benefits that would be strictly regulated.

In his testimony, Wyatt Bosworth, a lobbyist for the Connecticut Business & Industry Association, described the bill as “the most comprehensive, consumer-friendly Multiple Employer Welfare Agreement (MEWA) legislation in the country,” and said it would provide small employers a new option for healthcare benefits.

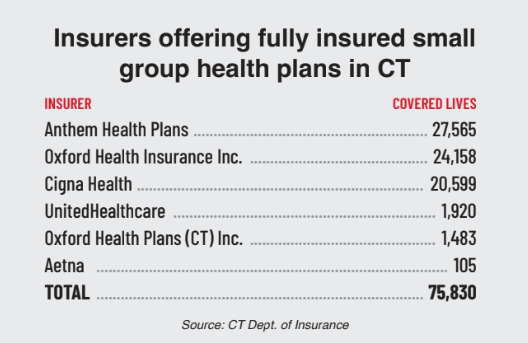

“One of the only tools small employers have that can boost workforce and productivity is the ability to offer comprehensive benefit packages that include affordable and benefit-rich health plans,” he said. “Unfortunately, due to volatile market conditions, the small group market is becoming more consolidated and less affordable every year.”

Connecticut has seen multiple insurers exit the small group fully insured health insurance market in recent years, including ConnectiCare and Harvard Pilgrim.

Bosworth cited a recent survey by the National Federation of Independent Business (NFIB) that found that 94% of small employers find it challenging to some degree to manage the cost of offering employer-sponsored health insurance.

Allowing the creation of MEWA Trusts would benefit small employers, he said, while adding that they are “subject to rigorous financial and solvency oversight by the respective state’s Department of Insurance as well as the federal Department of Labor.”

The bill contains several requirements, including:

- Direct regulatory oversight by the state Insurance and Labor departments.

- Strict requirements to offer robust plan benefits and design on par with the federal Affordable Care Act (ACA) market.

- Cover all ACA consumer protections codified under the federal Employee Retirement Income Security Act (ERISA).

- Maintain stop-loss.

- Apply consistent pooling points.

- Offer plans on a guaranteed issue and guaranteed renewable basis.

Other organizations that spoke in support of the legislation included the NFIB, Credit Union League of Connecticut, Motor Transport Association of Connecticut, Connecticut Retail Network, Connecticut Bar Association, and National Association of Benefits and Insurance Professionals.

Several organizations presented testimony opposed to the legislation, including the American Lung Association, Leukemia and Lymphoma Society, National Multiple Sclerosis Society, American Cancer Society, Connecticut Citizen Action Group (CCAG), and state Commission on Racial Equity in Public Health.

Gretchen Shugarts, an analyst for the Commission on Racial Equity, testified that the commission opposes the legislation because it will “further disadvantage people with disabilities and people of color.”

She stated that because “people of color are disproportionately impacted by chronic disease, businesses who employ a greater number of Black and Brown people will likely be charged more than businesses with a greater number of white employees.”

Tom Swan, executive director of the CCAG, agreed, stating that his organization believes the bill “will weaken consumer protections, discriminate against employers with older and sicker employees, and destabilize the existing individual and small business marketplace.”

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments