Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

-

News

-

Editions

-

- Lists

-

Viewpoints

-

HBJ Events

-

Event Info

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

-

-

Business Calendar

-

Custom Content

- News

-

Editions

View Digital Editions

Biweekly Issues

- April 29, 2024

- April 15, 2024

- April 1, 2024

- March 18, 2024

- March 4, 2024

- February 19, 2024

- February 5, 2024

- January 22, 2024

- January 8, 2024

- + More

Special Editions

- Lists

- Viewpoints

-

HBJ Events

Event Info

- View all Events

- 2024 Economic Outlook Webinar Presented by: NBT Bank

- Best Places to Work in Connecticut 2024

- Top 25 Women In Business Awards 2024

- Connecticut's Family Business Awards 2024

- What's Your Story? A Small Business Giveaway 2024 Presented By: Torrington Savings Bank

- 40 Under Forty Awards 2024

- C-Suite and Lifetime Achievement Awards 2024

- Connecticut's Health Care Heroes Awards 2024

Award Honorees

- Business Calendar

- Custom Content

Forecast says CT’s ‘fiscal cliff’ will be gone when pandemic aid expires

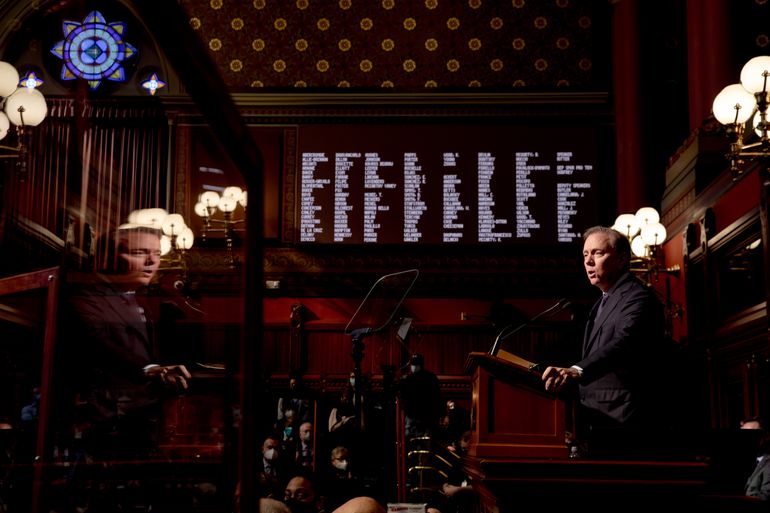

YEHYUN KIM / CTMIRROR.ORG

Gov. Ned Lamont presents his proposed adjustments to biennial state budget at the State Capitol in Hartford in February.

YEHYUN KIM / CTMIRROR.ORG

Gov. Ned Lamont presents his proposed adjustments to biennial state budget at the State Capitol in Hartford in February.

For more than a year, officials have been dreading “the fiscal cliff” — the chasm state programs would fall into once $3 billion in emergency federal pandemic relief expires.

But a new forecast, showing state income tax receipts will grow for years to come, has shrunken that cliff to something less than a pothole.

With inflation topping 8%, a war in Ukraine and Connecticut still down 74,000 jobs from pre-COVID-19 levels, is the news too good to be true?

Lamont: ‘As ready as you can be”

“When people say, ‘Oh my God, what’s going to happen when the ARPA goes? What’s going to happen if there’s a rainy day? What happens if the world changes?’” Gov. Ned Lamont said Monday, referring to the federal American Rescue Plan Act funds that will support state finances through 2025.

“We’re going to be as ready as you can be.”

There are numbers to support the Democratic governor’s confidence.

The legislature’s nonpartisan Office of Fiscal Analysis projected Monday that the budget’s General Fund would have a built-in hole of roughly $800 million in the 2023-24 fiscal year, when Connecticut would begin to curtail its use of pandemic relief, and $530 million in 2024-25, when the last of those funds would be spent.

Those represent funding gaps of 3.5% and 2.4% respectively.

By comparison, they are far smaller than the 18% deficit in 2011 that produced one of the largest tax hikes in Connecticut history, a nearly $1.9 billion hit.

“We have to do some things to address that, but it doesn’t wake me up at night,” House Speaker Matt Ritter, D-Hartford, said Tuesday, noting that the state’s rainy day fund, which is maxed out at $3.1 billion, can easily close that gap.

Further increasing the likelihood of a smooth transition in the out-years, Lamont and the Democrat-controlled legislature have agreed to use $3.6 billion of this fiscal year’s $4.8 billion surplus to pay down pension debt. That’s expected to lower the required minimum annual pension payments by roughly $280 million per year — a savings that’s not yet factored into the “fiscal cliff” calculations.

“The Lamont administration has taken a cautious approach in the use of ARPA dollars over multiple years to ensure a sustainable and balanced budget in future years,” added Lamont’s budget director, Office of Policy and Management Secretary Jeffrey Beckham. “We are paying down the state’s long-term unfunded liabilities, addressing the needs of our most vulnerable residents and creating an economic environment that attracts businesses.”

Analysts: CT tax receipts will continue to boom for years

But there’s an even bigger reason why — at least on paper — lawmakers won’t even need to dip into the budget reserve to solve these problems.

In a 2017 bipartisan deal, lawmakers created a new fiscal safeguard, a program that forces government to save a portion of volatile quarterly income tax receipts tied to investment and business earnings.

Since then, due largely to a stock market, the so-called “volatility adjustment” has saved, on average, nearly $1.1 billion per year. And that’s not counting the unprecedented $2.7 billion it’s expected to save this fiscal year.

Buoyed by those surging numbers, analysts for the legislature and Lamont now say the volatility adjustment likely will collect almost $1.4 million annually between 2023 and 2026 — nearly double the projections they released in January for that crucial period.

Once the volatility adjustment savings is applied, the projected deficits in 2024 and 2025 turn into estimated surpluses of $358 million and $675 million, respectively.

But some say that’s too good to be true.

Economic dangers still abound

The U.S. Bureau of Labor Statistics reported an 8.5% increase in the Consumer Price Index in March, the highest since 1982.

Oil prices continue to rise as the Russian invasion of Ukraine continues.

Deutsche Bank, which made headlines in early April as the first major bank to predict a mild recession in the U.S., stepped up its warning last week by forecasting a major economic downturn by late 2023.

“It [all] has the strong potential to result in a huge downdraft,” DataCore Partners economist Donald Klepper-Smith said Tuesday.

Klepper-Smith, who was the state’s chief economic advisor in the late 2000s under Republican Gov. M. Jodi Rell, said the stock market surge between 2018 and 2021 — and the huge, investment-related income tax receipts — have given legislators a false sense of security.

State government’s flush coffers are “because of a rich uncle, not because we’re earned it,” he added.

University of Connecticut economist Fred Carstensen also is skeptical the state can keep raking in big income tax receipts.

“We’re in a very different world,” said Carstensen, who heads the Connecticut Center for Economic Analysis. “I think it’s completely unreasonable to build in those kind of [revenue] expectations.”

Connecticut, according to the state Department of Labor, still hasn’t recovered more than 55,000 of the jobs it lost during the worst of the coronavirus outbreak in 2020. The state entered the pandemic down more than 25,000 jobs from the previous recession, which ran from late 2007 through mid-2009.

“Our basic economy is still very weak,” Carstensen added. “Our payroll has not recovered, our employment has not recovered to … where we were in 2008.”

Minority Republicans in the House of Representatives offered similar warnings late Monday and early Tuesday when majority Democrats adopted a $24.2 billion budget for 2022-23 that boosts General Fund spending more than 6% above current levels but also offered more than $600 million in tax relief.

And while Democrats said the pandemic has created great needs in health care, social services and early childhood development that had to be addressed, Republicans said the focus should have been less on programmatic spending and more on tax cuts, which could stimulate the state’s economy.

Democrats said it was one of the largest tax cuts — if not the largest — in state history. But the GOP countered that roughly half of the tax relief is one-time aid and tried unsuccessfully to add one thing the Democratic package was missing: a cut in state income tax rates for the middle class.

“There isn’t a lot here for the residents of Connecticut,” said House Minority Leader Vincent J. Candelora, R-North Branford. “This is a budget that’s working for government, not the people.”

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

Learn more

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

Subscribe

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

Read Here-

2022 Giving Guide

This special edition informs and connects businesses with nonprofit organizations that are aligned with what they care about. Each nonprofit profile provides a crisp snapshot of the organization’s mission, goals, area of service, giving and volunteer opportunities and board leadership.

-

Subscribe

Hartford Business Journal provides the top coverage of news, trends, data, politics and personalities of the area’s business community. Get the news and information you need from the award-winning writers at HBJ. Don’t miss out - subscribe today.

-

2024 Book of Lists

Delivering Vital Marketplace Content and Context to Senior Decision Makers Throughout Greater Hartford and the State ... All Year Long!

ABOUT

ADVERTISE

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments